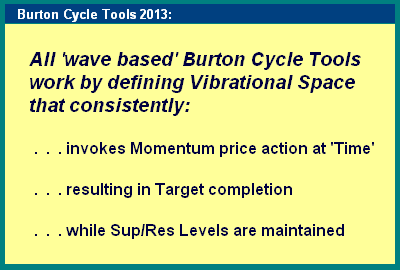

As you study the logic, look, and feel of Support and Resistance Trade Entry associated with Burton ‘Momentum Wave’ Cycle Tools, (detailed in the Help & Study Guide), keep in mind the following features and how you can use them to benefit both your trading and trade entry:

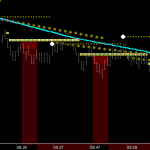

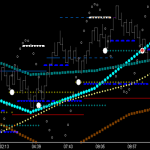

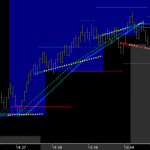

1. Geometry is projected in the future, enabling price/time relationships to be seen well in advance. Successful Trade Entry is based on these relationships.

2. Tools work the same on any size fractal (chart). Both trade entry fractals and directionally biased ‘bigger picture’ fractals used should be chosen with thought given to the vibration rate of the particular market being traded.

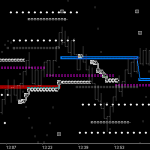

3. Most tools provide user selectable directional bias switching . . . . providing clear trade entry levels in sync with market direction.

4. Most tools identify momentum break-out timing points and price levels . . . ie the point of change from buying to selling, etc.

5. ‘Proof-Point’ Relationship Logic is employed in all tools.

6. All tools clearly show what you cannot do. Understanding this is fully half the battle . . . because it mandates patience for opportunity.

About Dox

I have been studying ‘Gnomonic Growth’ for as long as I have been trading. It would probably be true that the mathematical allure of this phenomena was the initial force garnering my attention, taunting my faculties, relentlessly teasing my puzzle solving ilk. This mesmerizing secret of nature, this beautiful secret of all things, turning me into a student of Vibration, a student of Phi, a student of gNomonics . . . Momentum Tape Readers are the culmination of 18 years of trading and research; including 8 years of programming, 6 years of mentoring, 3 intense years of changing everything to reflect 'wave based' directional bias and now compiling it all into the Help & Study Guide format. I can finely say . . . my journey is complete. I hope you enjoy the read . . . and more importantly . . . profit from the experience. Best to all, Dox.