BTS9_MTR_Crest

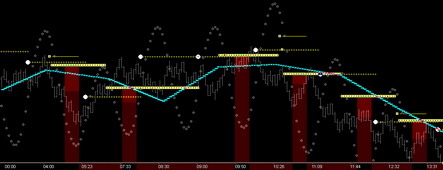

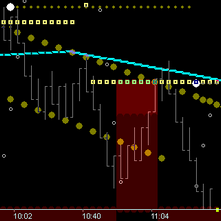

The MTR_Crest dll can be set to display the following Resistance features of the Burton Momentum Wave:

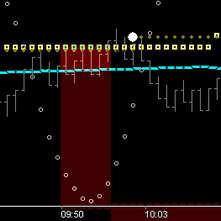

1.Crest (generated) Res Thermometer Cap level (crest mLkAhd falling below price, marks external Fib level and 16 to 21 time zone)

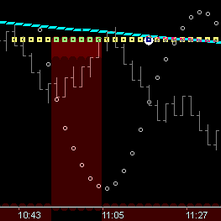

2.Option to display Trough (generated) Res Momentum Cap level (trough mLkAhd rising above price)

3.Option to display Trough (generated) Fib Vectoring (Tm21_FibPr anchor to user selected Fib Pr/Tm)

4.Option to use Auto Directional Bias output filtered by user selected Fib Price/Time Fence (shown in examples)

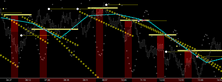

5.Option to display Fib Fences: Trough, Crest or both

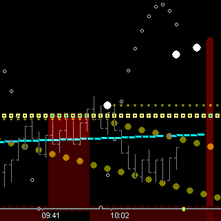

6.Option to display Fold-Over levels of the Fib Fences

7.Option to display Trend vectoring from Thermometer to Thermometer

8.Option to display Time Fences: Trough, Crest or both (overrides Thermometer display)

9.Option to display the Momentum Wave

Remember This Fundamental of Learning: |

Each of the vibrational components of this Wave Based tool provide a unique 'Squared' and 'Phi Rich' structure to any chart. Successful trading comes when two things are understood:

1.The structural RELATIONSHIP of the above features (specifically created by price action) and . . . 2. Price's position in 'Relation' to this 'RELATIONSHIP'

It is suggested and highly recommended that users add only one structure and concept to their trading at a time. Complete clarity of the trade precepts (action points) of each must be understood and internalized before a 2nd can be added successfully.

Observe . . . find what you like . . . observe . . . what speaks to you . . . observe . . . make it your own . . . use it.

This help file is about helping you accomplish that . . . review these charts often.

|

Learn More: