Wave Principles

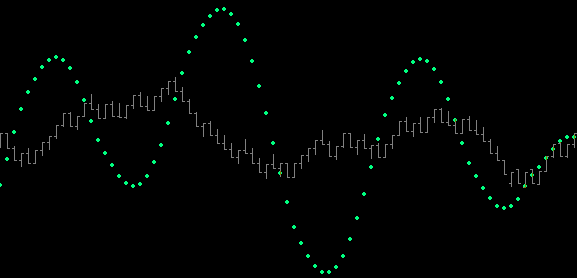

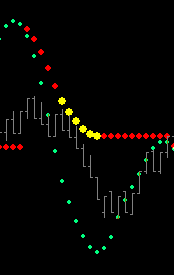

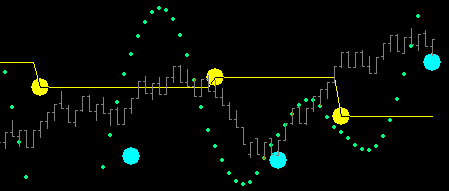

The Law of Vibration is a sequence of events which unfold as described below.

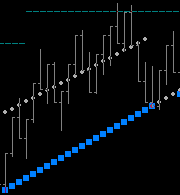

Any object vibrating will produce a wave as a function of time. That is to say, all vibration produces a wave form . . . momentum up . . . momentum down. Price vibration in the markets produce a consistent wave with a wavelength (period) of 26.

Note: The market wavelength of 26 will be found to be meaningful as understanding of the .5 damping wave, the 180* cycle, Phi count time, and the 45 Time/Price threshold is developed.

|

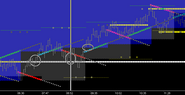

Wave forms produce opposing forces. The duality of [+] positive and [-] negative forces manifest (can be seen) in the damping waves which trail the primary vibrational momentum wave up and down.

|

Opposing forces produce friction as the momentum wave is penetrated. This process slows the momentum wave and eventually turns it . . . serving to perpetuate the wave.

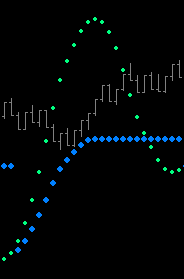

Note: The friction zone pictured here (a.k.a. SwtSptZn) is the .9, .707, .666, .618, .583, and .5 friction of the .5 damping wave. |

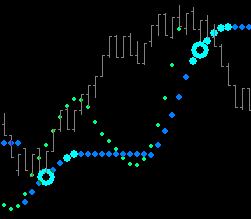

Friction creates a shock point of change (slowing momentum) which is new origin @ .707, the Sacred Cut of the damping wave. Time is this new origin point.

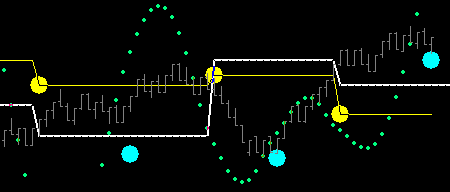

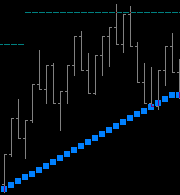

Viewed together . . .

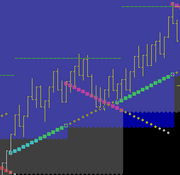

Note: From left to right . . . Price below Time is negative. Price above Time is Positive. Price above [-] Time is extremely positive. Price below [+] Time is extremely negative.

Notice in the above pic (from left to right): 1.Is price rising at [+] Time and rising above prior cycles [+] .5 level (blue) (ie 180*)? 2.Is price breaking above [-] Time and breaking above prior cycles [-] .5 level (red) (ie 180* and 270*)? 3.Is price dropping below [+] Time and retracing to prior cycles [+] .5 levels (blue) (ie 270* and 180*)? 4. Is price likely to find support at these prior levels?

Logic: Since the answer to 1 and 2 is yes . . . the answer to 3 must be yes.

|

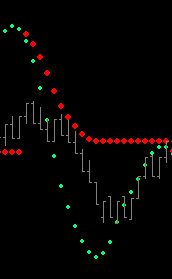

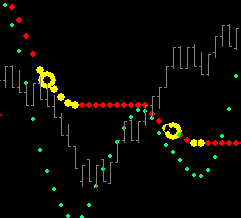

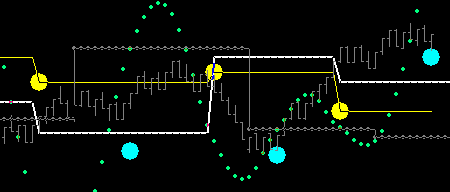

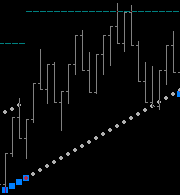

Time is also price at origin. While origin is beginning and Phi flows from beginning (which sets up Fibonacci structure in the future both as Price and Time), price @ time marks significant horizontal price levels that come into play in the current cycle, next cycle (180*) and the next (270*).

Though not shown above . . . notice the support of the prior cycles Price level of [+] SCut Time (cyan).

The 270* SCut level (white above) is exceptionally significant. Notice the effects above when tunneling either the SCut level or the 270* SCut level.

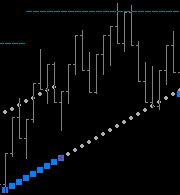

A 3rd level of significance is the extension of the .5 level of the rising [+] damping wave from below, shown above in grey. As an extension of the prior cycle, this level is the 180* look back to positive midpoint of the prior wave. Any significant positive price action will be above this level. As shown above, unless breaking out, price spends the majority of its time bracketed by these levels.

Above pic clarifies the grey level as the extension (180*) of the blue friction level marking the .5 level.

|

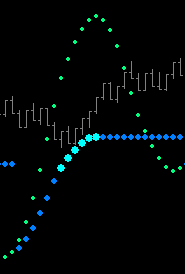

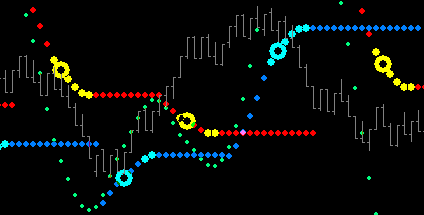

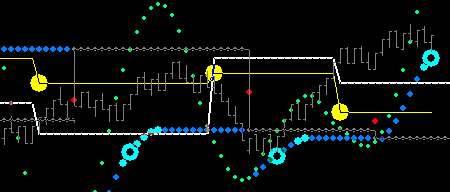

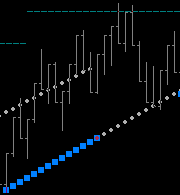

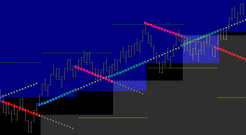

From Price @ Time (friction point) comes threshold. Threshold is the action state of Time/Price found in the future as the effect or reaction to the friction point generation of origin.

Since time flows from origin then each step in time has a relationship with price, i.e. time over price, and thus is born the vector. In this case, a friction vector. Specifically generated by the self-perpetuating wave of vibration. These vectors and other primary directional bias information are output with the mWav_TrdFltr dll.

Maybe you're thinking, "isn't that picture a very filtered selection for it's perfection?" Absolutely! But the starting point for understanding vibration is to know what perfection looks like. And perfection is relative. In the above example price could have retraced to the friction vector at Tm3, Tm5, Tm8, Tm13, Tm17_18, Tm21, anywhere. Any bounce at a time threshold with follow through would be perfect. Any failure at any of these thresholds would be 'perfect'. So it may seem that perfection has nothing to do with the reality of trading in real-time, but that is not true. Once you embrace or understand the core tenets of vibration, the precepts of squares and XPansion, then you are free to look at a chart, see what price is doing, (ie. 'Read the Tape') and once you know that then you know what price 'has' to do next to either continue doing it or change.

English please . . .

It's easy to point to thresholds in hindsight and analyze perfection in it's many forms. Successful real-time trades will only occur when they are taken in sync with momentum and 'risk vs reward' at entry is known. So what separates a winning trader from a loosing trader is only one thing . . . the trader's approach to directional bias. It's funny that the most successful traders of the past have all been Tape Reader's. For our purpose's here we will sum that up as "Is the market making higher lo's_higher hi's?, or NOT!"

If it is? . . . for trading purposes then, we need to know the support level(s) for that action to continue or fail.

If it isn't? . . . then we need to know at what price level (and when in the future, ie. Time) could that price action possibly start.

Stop laughing for a moment and understand . . . that's all you need to know. And the answer is found in prices position relative to prior cycles crest and trough time levels.

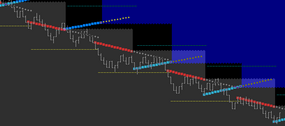

And the opposite is true when price is not in a positive position. Just like in a rising market, retracements in a falling market move consistently to Time Level threshold. That is what price does. The question is whether you know where these time/price thresholds are? So risk of any geometric precept entry at retracement is easily measured. Remember that a market that is completing downside XPansion targets, is not positive. (click image below to enlarge)

Trading for continuance (the correct action) will take a loss if things change. Judging whether any particular retracement to time level threshold is likely to break through and change the momentum direction is most easily anticipated by following a larger fractal. The below pics follow the Euro thru 2 days of momentum trading. See if you can see threshold entries, wins and stops.

|