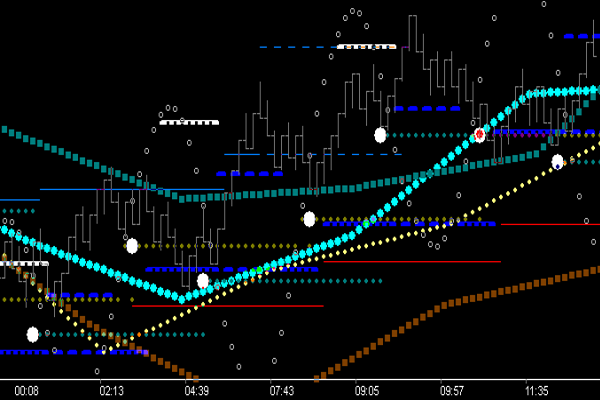

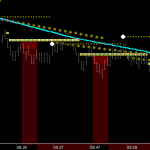

The MTR_UT dll functions as a wave support dll providing a fast and complete source for many structural components to be displayed as desired. It also can easily function as a stand alone trade environment, painting a clear picture of what state price is in. Because of this, it is a good source dll to play with and study as you get familiar with Fib Fences, Fib Levels & Targeting, Fold-Over Levels, Fib GateWay Break-Outs, Tm Fences, and Pr/Tm Target Vectoring & FishTails (Lead-Ins).

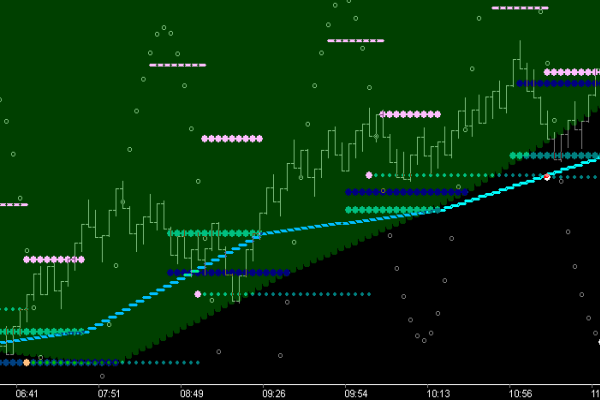

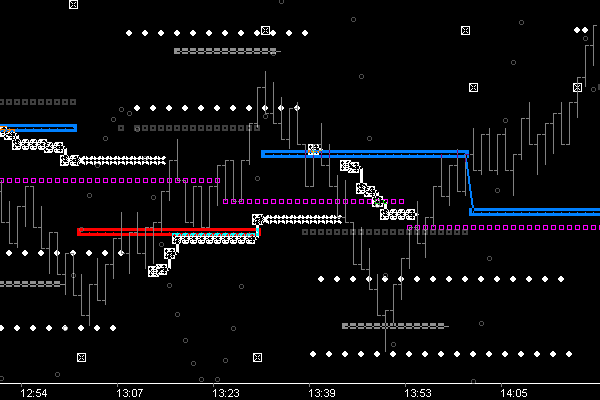

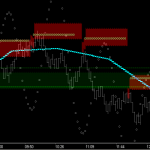

Wave Mechanism: When the rising mLkAhd of the trough turn exceeds price (the trough shock-point), the Fib_0 level is displayed as resistance/target zone across the Crest phase of the wave. When the falling mLkAhd of the crest turn exceeds price (the crest shock-point), the Fib_0 level is displayed as support/target zone across the Trough phase of the wave.

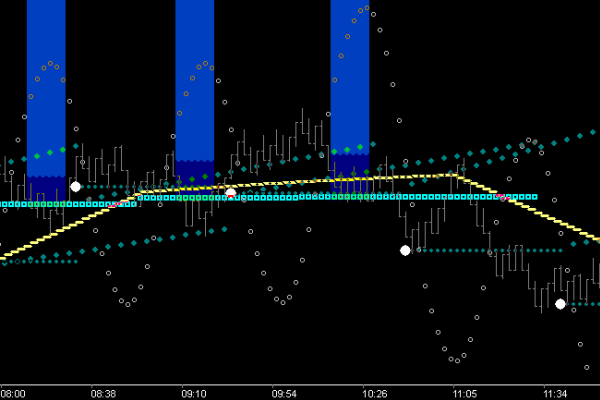

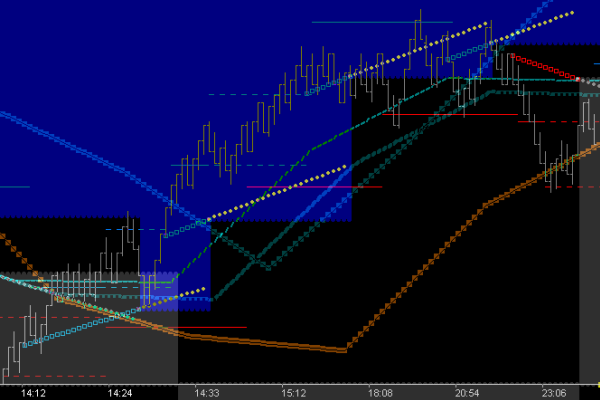

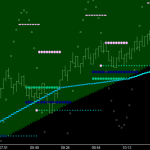

Fib Fence Mechanism: The momentum shock-points create LkAhd differential vectoring, thus generating a Fib structure in terms of both price and time. Marking FibLv13@Tm21 from one cycle to the next creates a vector (or Fib Fence) that tracks whether the FibLv13 is rising or falling, and shows whether price is above or below this fence. The opening in the fence marks the rotation point (ie Tm21, ie the PrTm anchor point) for the projection of the fence in the next cycle. Essentially this ‘Fold-Over’ level is the base of a Fib-Square, and can be shown.

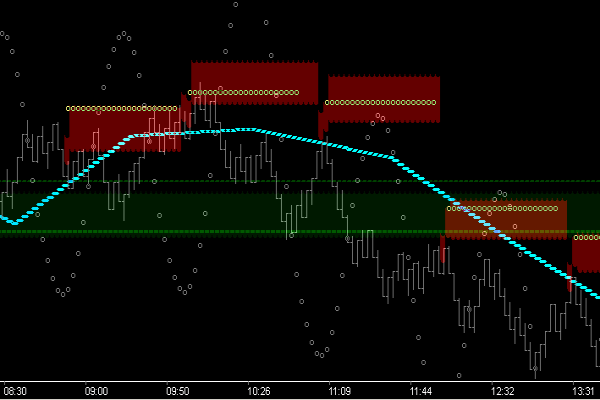

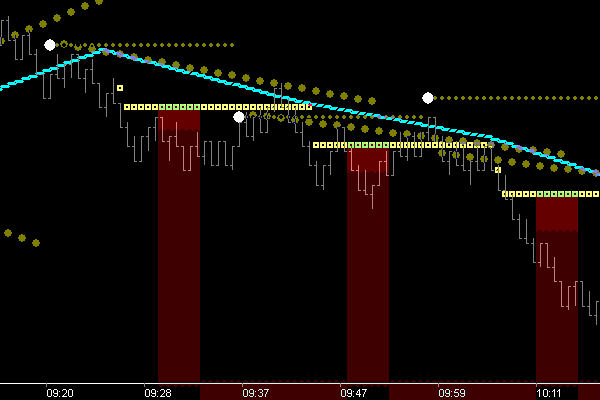

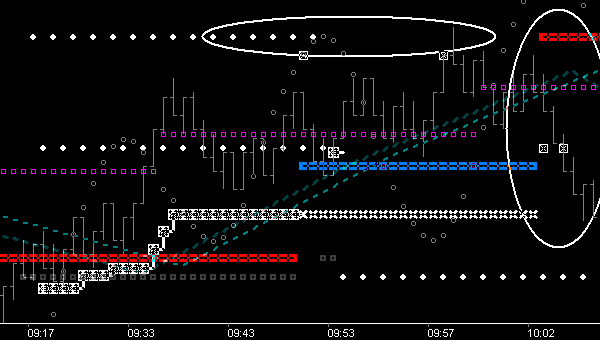

Fib_8 Targeting: Part of the self-generating aspect of the wave is that price is consistently finding its way to the Fib_8 level of the opposing forces. Note: Because of this, targeting these levels works exceptionally well when your directional bias criteria is met. Both Fib Fences and Fib Fold-Over Levels can be constructed to provide max reward/min risk opportunities as demonstrated in these charts.

Fib GateWay Break-Outs: Price moving beyond the Fib_8, Fib_5, Fib_0 level, is breaking out to higher or lower targeting, but you need entry. Fib Fences can be used to highlight or define this break-out zone in a variety of ways.

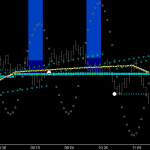

Tm Fences (from trough/crest friction vectors): Any combination of standard Tm fences can be output using this dll. Much has been written elsewhere regarding standard structures such as 13,17; 17,21; 21,26; 26,34; etc, and trough vs crest.

Pr/Tm Target Vectoring & FishTails: Since price has an extreme predilection to accomplish the Fib_8 levels, it should follow that a vectoring mechanism should exist that points a path to that level. We also know that the fold-over level of fences are essentially the Base and Top of Squares. So . . . might it not be useful to project form that ‘horizontal’ (base/top level) towards the target level at some ‘relevant’ time point, say . . . 72, 81, or 90. Doing that can provide a unique perspective as price applies into a change point, ie helping you read the story of price action.