As you study the logic, look, and feel of each Burton ‘Square Based’ Cycle Tool (detailed under the Support Structures topic), keep in mind the following and understand that it can take quite a bit of observation over time to achieve proficiency:

- In general these tools give ‘Big Picture’ confirmation of price’s relative position overall.

- Specific tools are typically used on a specific size chart (ie a ‘Legacy’ chart) that is so good it cannot be overlooked.

- Some tools are used to give very specific information following very specific events.

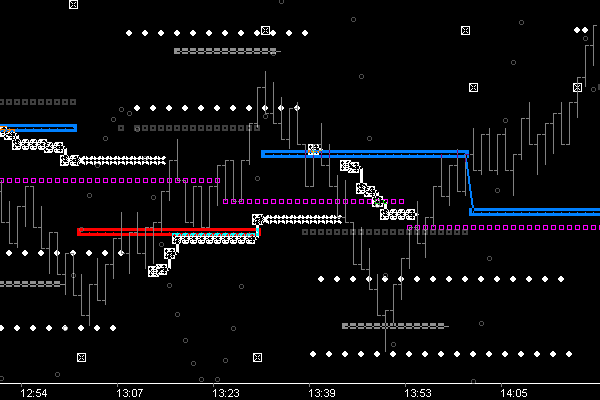

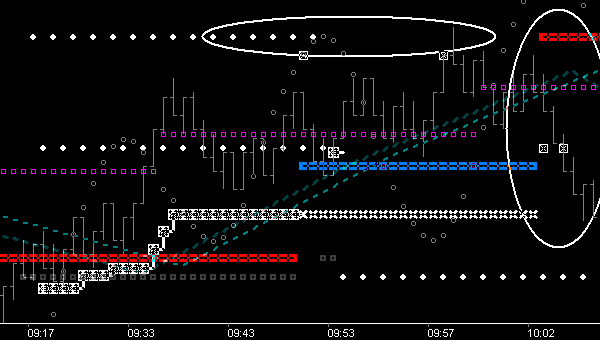

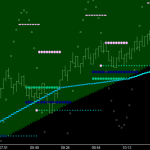

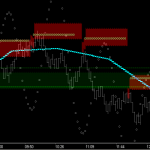

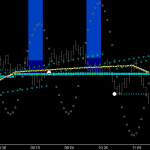

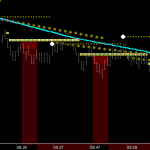

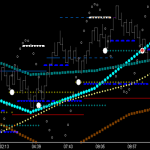

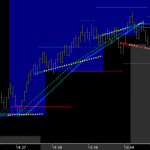

The ‘Return Point’ mechanism of the MTR_IRFmmXL dll demonstrates this nicely and is what we call an IRF (Inertial Reference Frame). The IRF levels of each cycle are output in blue/red based on price’s relationship with the 270* price level of the cycle. This process works exceedingly well for tracking trends as well as reversals, and reversals specifically invoke a reconciliation state, which is a fundamental ‘Law of Vibration’ precept. This cycle tool features both targeting (‘Law of Three’ based), reconciliation level (‘Market Maker’ based), and expansion level tracking (‘Phi’ based). The picture below shows how knowledge of the reconciliation level, ie Return Point, can be used in conjunction with knowledge of price’s momentum position above the Trough Tm Fences.

Dox Box . . .

The imperative read for understanding is found at the 'Law of Vibration' site . . . Topics: ' Directional Bias', 'Time/Price 45', and 'Fractals' . . . Read . . . Understand . . . and find Success.