To trade successfully you need 3 things:

1. Knowledge . . . of ‘directional bias’, ‘price targeting’, and the ‘relational price/time components’ which will align and provide clarity to the markets intent.

2. Patience . . . to wait for the alignment of price and time, which gives favorable reward to risk from a specific entry level.

3. Discipline . . . to take the profit or loss the market gives, knowing the next favorable setup is only a matter of time and will be recognizable by you.

While that may sound easy. . . it simply is not. It takes time and it takes not only time, it takes pursuit of the correct approach over time. That approach, I believe, specifically mandates that you study . . . to the point of understanding . . . the nature of the markets. That core nature being one of ‘Opposing Forces’.

Your ‘Stages of Comprehension’ should come in this order:

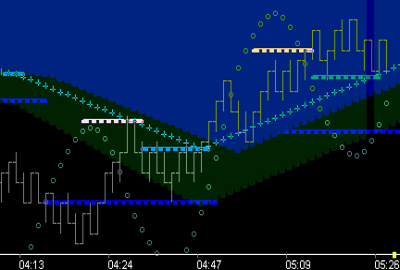

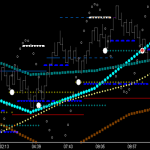

1. Focus of Intent . . . price action consistently creates targeted price levels supported by current directional bias.

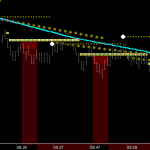

2. Threshold of the Opposing Force . . . vibrational truth produces retracement moves to the relevant support/resistance levels of the cycle.

3. Point of Proof Alignment . . . time both facilitates and is established by the alignment of price and the price/time structure across fractals, a necessary component for continuance.

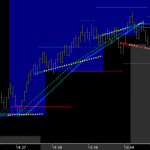

4. Momentum . . . at time, will uphold or cross the point of proof established by the retracement, thus confirming the move to target (ie, time is now)

5. Trade Entries . . . in this zone of retracement, provide for max reward with minimum risk which will build consistent profit over time. Each of the above are consistent and reoccurring phenomena of the markets. Mastering your recognition, understanding, and implementation of each is your objective. My experience can tell you that numbers 1, 2 and 4 come readily with observation, while items 3 and 5 take serious work. Yes it is not easy . . . but it is a journey well worth the undertaking . . . and necessary as you pursue the goal of trading for success each day. If you are already successful with your present approach to trading it is very important that any price/time component (ie, layer of information) added to your current method be fully understood and integrated over time. Many BTS tools deal specifically with directional bias and it is anticipated that they will facilitate increased success when added to any system. In this help file you will find many of my own perspectives detailed . . . but in the end . . . following your observation of and experience with Burton Cycle Tools . . . you will make it your own.

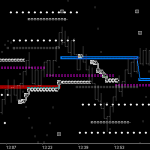

Dox Box . . .

The imperative read for understanding is found at the 'Law of Vibration' site . . . Topics: 'Time/Price 45' and 'Fractals' . . . Read . . . Understand . . . and find success.