It is quite difficult to change you . . . the core you . . . all those subtle and some ‘not so subtle’ individual idiosyncrasies that in the end . . . are you. And You . . . are very hard to change. Over the last 6 years of mentoring traders I have found this the most challenging aspect of mentoring and I have come to understand it is better for you to just embrace your personal make-up and trade in sync with yourself.

Ironically . . . by embracing yourself initially . . . change can then come as observation over time will refine your belief system and empower you to change . . . in many ways.

Some examples of how you might apply your personality to your trading:

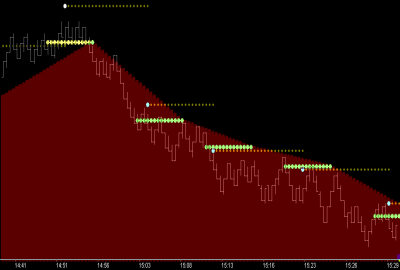

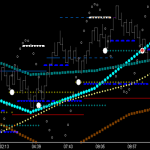

➢If you see the glass as ‘half-empty’, you will probably do better shorting in a market that has a negative directional bias. You would be best advised to not trade a positive directional bias . . . ie, wait for the change to negative directional bias and trade only shorts. (Do the opposite if you are a ‘glass half-full’ type.)

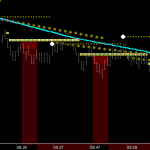

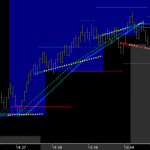

➢If you are the nervous type and always take profit quickly, then you will do better trading a smaller chart (smaller fractal). You will not do well trading for 5 ticks by looking at a 21-tick range bar chart. This applies to stops also. If you insist on a 5-tick stop . . . you cannot trade a 21-tick chart successfully because time to next valid trade is too long relative to reward. Build your charts according to your ability to hold onto a winner moving to price target.

➢If you don’t do well with relationships . . . Burton Cycle Tools may not be right for you. 🙂

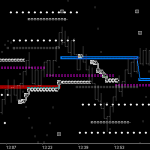

Dox Box . . .

The imperative read for understanding is found at the 'Law of Vibration' site . . . Topics: 'Time/Price 45' and 'Fractals' . . . Read . . . Understand . . . and find success.