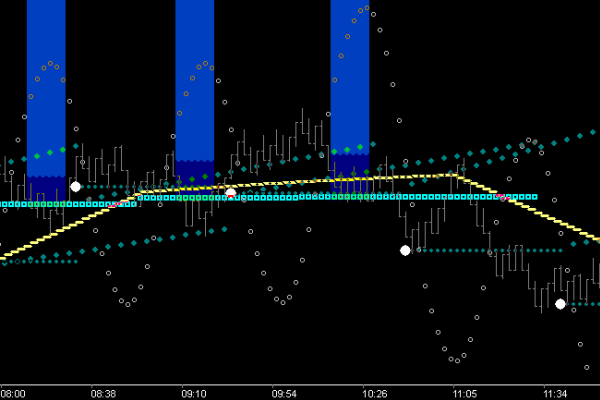

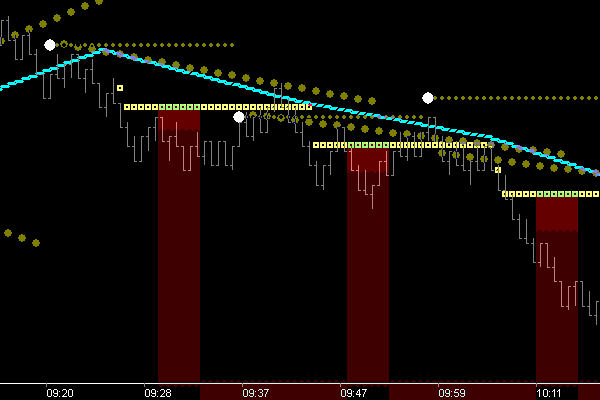

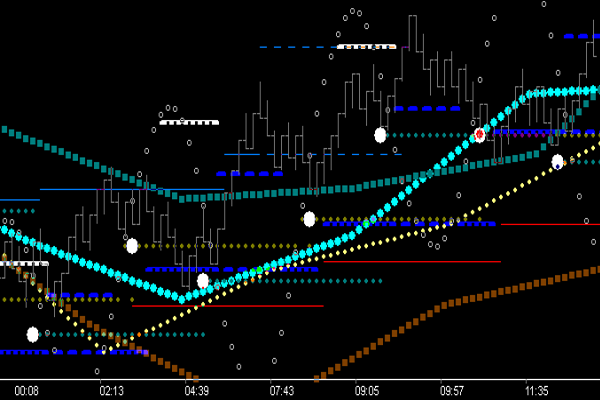

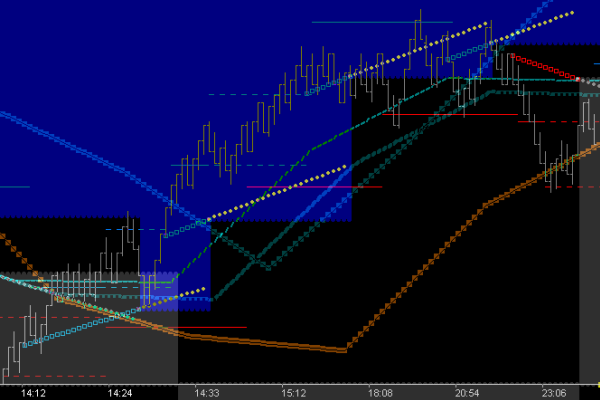

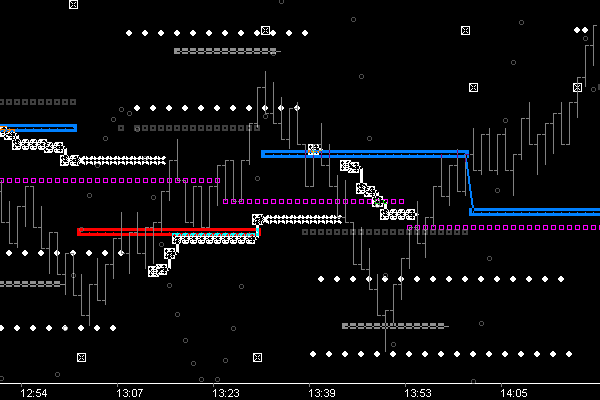

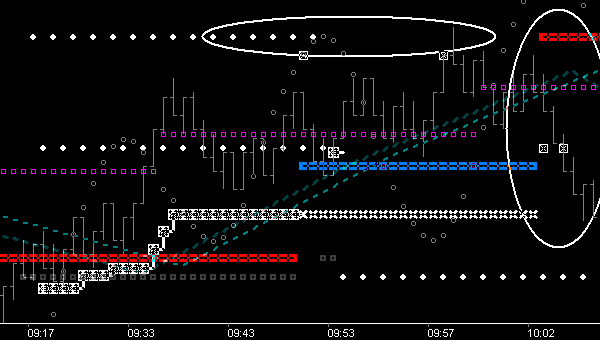

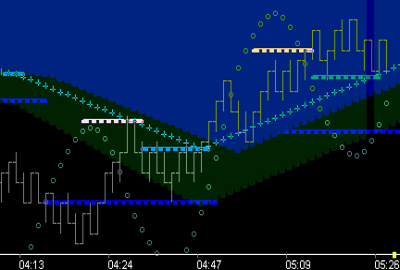

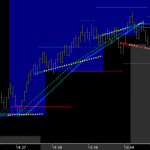

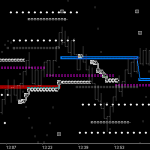

The MTR_Trough dll displays the support levels of the market generated at both the Trough ‘Shock-Point’ and Crest ‘Shock-Point’ of the wave. Directional Bias output is selectable by user, using any Price/Time Fib Fence desired.

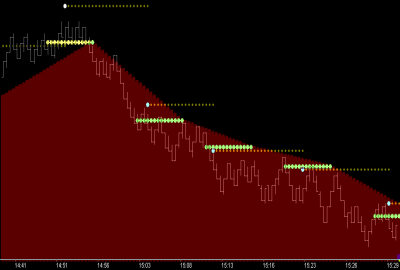

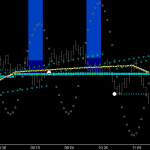

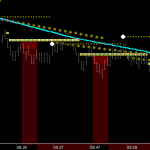

Trough Mechanism: The rising ‘Look-Ahead’s’ (Momentum & Time), of the trough turn, are tracking position relative to the Fib Structure. When the mLkAhd exceeds momentum (trough shock-point), two Fib levels are locked: 1. External, the last Fib level tracked below LkAhds and 2. Internal, the Fib level between mLkAhd and TmLkAhd. The ‘External’ price level becomes a very strong ‘Cup’ of support under the Crest phase of the wave. When broken, this support level becomes resistance. Specifically . . . price movement below is breaking down with dropping momentum . . . a stage set for lower hi’s and lower lo’s.

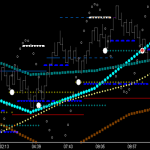

Trough Thermometer: Cup of the thermometer is the external Fib level described above. The thermometer itself is a count structure, the right side of which is a 21 count from shock-point. The left side is 16 counts from shock-point, ie Time. This ‘count’ zone serves to consistently remind you, as a trader, to monitor what price is doing as it ‘applies’ into the ‘decision point’ 21.

Fib Vectoring: This ’21 External Fib Point’, this ‘Fib_Tm/Pr Decision Point’ is extremely useful as a vector anchor. Users can select whatever Fib level they want to project to, or two auto selection modes are available, either Crest or Trough. When it comes to support/resistance and fences/vectors, it has been found that using the opposing force provides consistent results. So, with this Trough tool, I choose Crest Fib for the auto setting.